Congratulations! Your Zoom Space and Early Birth Discount have been reserved. Scroll down to complete your registration and secure your Q4 2023 MasterClass INSTANT ACCESS

Ambrose Here Again,

Welcome to the best decision you can ever make for the next 90 days. Now before we proceed let's talk little about money and its important function. I know that you are not new to this but for the sake of emphasis and having a deep understanding of how inflation affects our finance if it not multiplying as expected.

Money is a commodity accepted by general consent as a medium of economic exchange. It is the medium in which prices and values are expressed. It circulates from person to person and country to country, facilitating trade, and it is the principal measure of wealth.

Some functions of money include

Functions of Money

A medium of exchange.

A standard of deferred payment.

A store of wealth.

A measure of value.

We all exchange our services to get money as value for the services provided or goods sold and to thereby store the money.

Danger of just keeping money without multiplying it

However, there is a danger when you store money without putting it to work. The danger is very simple inflation.

Inflation measures how much more expensive a set of goods and services has become over a certain period, usually a year. It may be one of the most familiar words in economics. Inflation has plunged countries into long periods of instability.

Simply put, if you store your wealth in a bank without putting it to use then inflation will eat up the value of the money.

Identifying Opportunities in a Crisis

In Kufa, a small city ninety miles south of the capital of Iraq, there is always riots and protesting close to the US Embassy. In the quest to end the riot without resulting into violence, an army major had to analyze videotapes of recent riots and had identified a pattern: Violence was usually preceded by a crowd of Iraqis gathering in a plaza or other open space and, over the course of several hours, growing in size.

Food vendors would show up, as well as spectators. Then, someone would throw a rock or a bottle and all hell would break loose.

When the major met with Kufa’s mayor, he made an odd request: Could they keep food vendors out of the plazas? Sure, the mayor said.

A few weeks later, a small crowd gathered near the Masjid al-Kufa, or Great Mosque of Kufa. Throughout the afternoon, it grew in size. Some people started chanting angry slogans. Iraqi police, sensing trouble, radioed the base and asked U.S. troops to stand by.

At dusk, the crowd started getting restless and hungry. People looked for the kebab sellers normally filling the plaza, but there were none to be found. The spectators left. The chanters became dispirited. By 8pm everyone was gone.

Inflation and the Economy... Is your hard-earned money safe?

Inflation is the sustained and broad rise in the prices of goods and services over time; it erodes purchasing power. A small but positive inflation rate is economically useful. High inflation tends to feed on itself and impair the economy's long-term performance.

Common Effects of Inflation

1. Erodes Purchasing Power

2. Impacts Low-Incomes

3. Curbs Deflation

4. Feeds on Itself

5. Raises Interest Rates

6. Lowers Debt Servicing

7. Reduces Unemployment

Apart from that let's look further and personalize the effect of inflation on your portfolio without wasting any time

Check below for the official inflation data from January 2024 to July 2024 shows 33.4% which is very high...

As you know the current unofficial inflation data is far above it.

The Mirage of getting certainty in an uncertain world

Some investors who want certainty in an uncertain world will for fixed deposits plus other fixed commodities that have fixed rate. Unfortunately, none of the rates are above the current inflation figure and at the end of the day you will lose on both sides because both interest and part of the principal will have been eaten up by inflation.

That is need to do the needful and understand how things work in life. Simply put, don't leave your money idle or semi-idle. Let it work for you.

Masters are smiling because they Understanding The Complete CODE For Making Money & Predicting Market Turns every Quarterly either bulls or bears

That is why you have the Master class so as to edge your and keep making high gains in the market.

For instance, if you have been following my Master Class then I believe you know exactly the average you would have made by now. This is far above the inflation rate.

If you have been investing a certain amount since the beginning of 2024. This is what you would have gotten now.. Which you can't get in other markets.

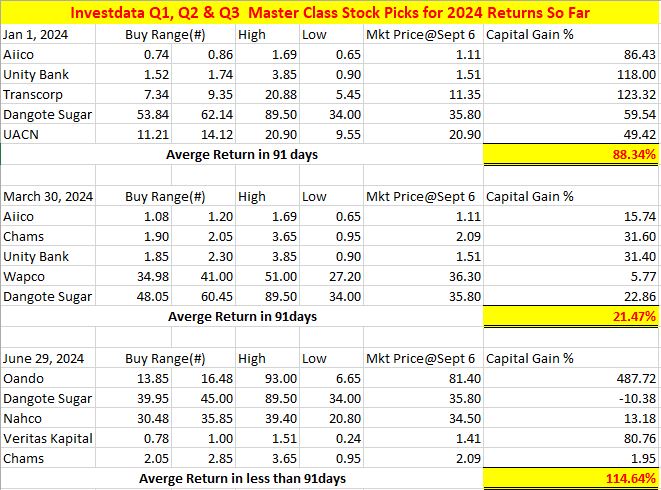

Q1, Q2, Q3 2024 MasterClass Super Bullish Return so far...

Going by the above analysis you will see that InvestData Master Class is a full proof hedge against inflation. That is, any investor who has been participating and taking action in the above stock picks would have grown his portfolio by an average of 74.82%. This is over 280% of the interest rate, beating inflation by 2.2x.

Now let's talk with numbers...

If you invest 10 million in January with a fixed interest rate of 26.75% is 2.67million as at the end of 365 days the buy power of your 10 million has reduced.

When compared to the stock market this is your return on investment. 10 million by the end of Q3 which is 9 months would have increased your investment by just an average only of 74.82%

If you don't understand the above analysis kindly go through the below video titled-Master Class 2024 Stock Picks Performance Ahead of Peak Season.

In this video, you will discover how Master Class Attendees have increased their portfolio by 74.82%

Action Time

Now the question is how do you position and benefit from the opportunity in Q4? That is exactly the reason why I took my time to organize MasterClass every quarter so that you can prepare and make the right decisions for yourself.

Hence, I hereby announce INVESTDATA Q4 MASTER CLASS

Theme Understanding The Complete CODE For Making Money & Predicting Market Turns

Sub-Topics

- 1. The Power of Market Timing & Momentum Trading in Any Cycle

2. Discovering Support and Resistance Levels On NGX with Candlestick Patterns For

Profitable Trading

3. Understanding Macroeconomic Data for Sector Rotation & Position Taking

4. Importance of Numbers in Profitable Trading & Stock Picks

5. Actionable Trade Ideas & Hot Stocks For The Season

Date: Saturday, September 28th, 2024

Venue: Zoom

Time: 9:00am to 4:00pm

Wondering??? Why you must take action or what you will get?

2023 Q4 Masterclass: Thriving In A Changing Macroeconomic Climate: Identifying Opportunities, Waves & Paths On NGX

Smart domestic investors understand the power of money flow and timing in wealth creation through stock trading and investing.

This Q4 masterclass is for you, because it will help you follow exact steps in real time, using the new strategies by following the current volatility and happenings in the market.

Nigeria has entered one of the greatest inflationary periods in the last six months, which is threatening investment and economic activities. And government policies through their economic managers had pushed millions of Nigerians down …. Out of the middle class…out of private retirement, healthcare and decent lives, based on independence and privacy… into a collective nightmare we call financial lockdown.

This is what happens when people are trapped by their own collapsing currency, such that they become deeply indebted. Inflation causes huge distortions in the economy and in the markets, so its critical that you take the necessary steps to ensure you are not left behind.

So the question is, Are you interested in learning how to safely navigate the financial market in today’s trading and investing environment that is clouded with uncertainties and surprises that are driving the volatile markets across the globe? Despite these headwinds, discerning investors and smart traders on the NGX are cashing out high profits with practical strategies of effective combination of fundamentals, technicals and sentiments analysis of the professionals and experts in the market. These they will share at the forthcoming Investdata Q4 Master Class, which we believe is for you. Among others, we know you will learn exact steps in real time using the new strategies by following the current volatility and happenings in the market.

The Choice is your to Decide if you are in or out...

What are the benefits you will get by enrolling for the Q4 MasterClass?

We have put together this Q4 masterclass to help market players avoid those needless losses and build a profitable portfolio that has high ROI…... Especially in a volatile market, when you don’t know which way up….

Participants will learn the following

- How to hedge against inflation and preserve capital in sectors and industry with the potential to drive profit that will support equity prices.

- How sentiment and technical analyses have helped many trader succeed in this highly volatile market environment.

- How to filter market noise and identify the most opportune time to join any trade.

- Workable and practical strategies during any market cycle that signal real money making opportunities to boost bottom line

- 5 hot stocks that can deliver returns double inflation rate and deliver over 50% within a short timeframe.

- How to buy right on the both sides of equity investing- fundamental vs technical, risk vs profit, buy vs sell and bears vs bulls.

If I do things on my own, what will happen...

Frankly, nothing will happen except the consequences of your choice. In clear terms, gambling with your hard earned cash. You will now be stalk in the position...hoping and praying that it goes up. Don't say that I did not warn you.

I still attend seminars and training online. I still pay more monthly and annual subscription fees in both local and foreign currency for different Master Classes so that I can be up to date because the market is always changing and what you know yesterday can be irrelevant today.

With the power of your choice, The Decision Power is with you to either improve your portfolio like the smart Investors or complain about the market... Hence, make the wise choice now

Now, here is the decision time, in other to finalize your spot for the 2023 Q4 Masterclass: Thriving In A Changing Macroeconomic Climate: Identifying Opportunities, Waves & Paths On NGX

you need to follow the below STEP NOW

Pay 50,000 into InvestData Consulting Limited Zenith Bank 1013815737. After Payment Send the details of your payment including name, email address and phone number to 08028164085 to complete your registration it expires on 29th September, 2023.

Early Bird Discount will Expire on

Here are our Team of Experts that will be presenting in this Q4. Don't Miss out!!!

Alhaji Garba Kurfi, MD/CEO APT Securities & Funds Ltd)

Topic: Navigating Market Dynamics: Insights For Profitable Strategies

Mr Olatunde Amolegbe, MD/CEO, Arthur Steven Asset Management Ltd

Topic: The Power of Macroeconomic Data In Equities’ Trading & Investing

Mr Abdul-Rasheed Momoh, Head Capital Market, TRW Stockbroking Limited

Topic: Mastering Market Volatility: Chart & Analysis For Higher Returns

Mr. Ambrose Omordion, CRO Investdata Consulting Ltd

Topic: Understanding The Link Between Fundamental, Technical and Sentiment Analyses In Picking Stocks

Best Regards

Ambrose Omordion